Asean emerges as China alternative as US role as ‘cheerleader’ of globalisation fades

- China retains ‘very important role’ even as Asean emerges as front runner for firms looking to diversify beyond China, panellists said at a Post conference

- The US’ withdrawal as a ‘cheerleader’ and driver of globalisation has been the ‘most critical change in last 20 years’, one observer said

Opening on Wednesday, the two-day event had some 250 people in attendance and focused on topics ranging from the strategies of Southeast Asian economies amid the US-China strategic contest, supply chain diversification and the growth of family offices in Asia. Around 500 people watched the conference online.

“The purpose of the conference is to help with bringing us all one step closer to realising our vision of a prosperous, sustainable future in Asia,” So said.

How Asean can bridge the yawning gap between the US and China

On Wednesday, panellists discussed the US’ role as the international driver of globalisation and how Southeast Asian states would deal with US-China tensions.

Singapore will feel ‘spillover’ effect of growing US-China tensions: minister

Danny Quah, an economics professor and dean at Singapore’s Lee Kuan Yew School of Public Policy, said Washington’s withdrawal as the “cheerleader” and driver of an increasingly globalised world had been the “most critical change in the last 20 years”.

“We might say that America remains committed to a system of exchange, but it’s a very different kind of exchange than the globalisation that we had in these last 20 years,” he said.

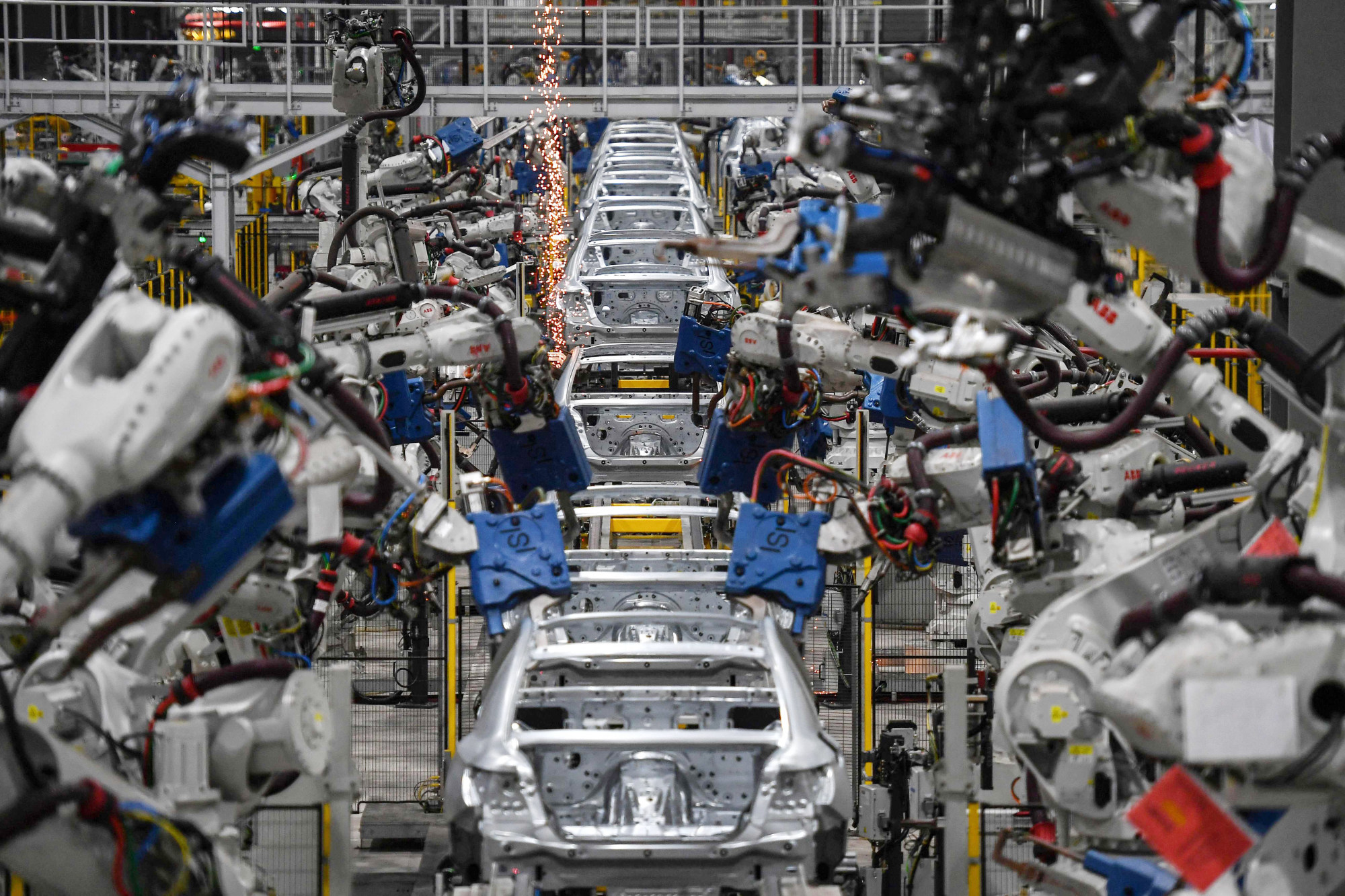

On whether Southeast Asia had the capacity to step up as an alternative to China and act as a host for businesses, supply chains and factories, Marc Mealy, senior vice-president of policy at the US-Asean Business Council, said the region had definitely become a front runner.

“For multinationals not looking to leave China but looking to diversify their networks to have a … (China-plus strategy), there’s no question that for Asean member states, that’s been one of the biggest opportunities,” he said.

China’s loss is Southeast Asia’s gain as supply chains shift

However, this did not necessarily mean the region would replace China, said another panellist.

Justin Kent, president of supply chain solutions at Li and Fung, said retailers were focused on good costs, quality, innovation and speed, regardless of whether it was a Chinese, Indian or Southeast Asian manufacturer.

“They’re doing different things to respond to that need, like lower quantities, sharper costs, reducing margin and maybe holding inventory in Asia for those reasons,” he said.

Vietnam had emerged as a strong candidate for Chinese manufacturers looking to diversify their supply chains because of its close location to China and cultural similarities, Kent said, though he noted that there were some limitations due to its size.

Echoing his sentiments, Fion Ng, chief operating officer at logistics properties provider BW Industrial, said the interest in Vietnam was not a new one, with Japanese, South Korean and Taiwanese businesses having turned to Vietnam as early as 15 years ago.